Strategic Management Finance: Definition and Importance

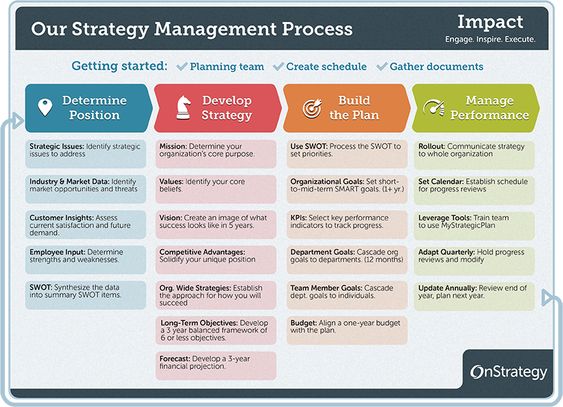

The world of business is constantly changing, and in order to remain competitive, it is important to have a well-developed strategic management finance plan. Strategic management finance is the process of planning, monitoring, and controlling financial resources in order to achieve organizational goals and objectives. It is more than just managing money, but rather a strategic approach to financial decision-making that can help a company thrive.

Financial Planning: Components and Principles

Financial planning is one of the key components of strategic management finance. It involves forecasting future financial needs and allocating resources in a way that will achieve business goals. Some of the key principles of financial planning include identifying the company’s financial goals, determining the necessary resources, developing a budget, and tracking progress over time.

Investment Strategies: Types and Tactics

Investment strategies are another important aspect of strategic management finance. There are several different types of investment strategies, including growth, value, and income investing. Each strategy has its own unique approach to investing, and business owners must carefully consider their options before making a decision. Additionally, there are several tactics that can be used to minimize risk and maximize returns, such as diversification, asset allocation, and dollar-cost averaging.

Risk Management: Techniques and Tools

Managing risk is an important part of strategic management finance. In order to minimize risk, entrepreneurs must have a good understanding of the various techniques and tools available to them. These can include insurance, hedging, and even contingency planning.

Cash Flow Management: Strategies and Tips

Cash flow management is critical to the success of any business. It involves managing the inflows and outflows of cash in order to maintain liquidity and avoid financial distress. Some of the key strategies for cash flow management include forecasting cash flows, establishing credit policies, and reducing operating costs.

Budgeting: Methods and Benefits

Budgeting is another key component of strategic management finance. It involves creating a financial plan that outlines expected income and expenses for a specific time period. Budgeting can help businesses control costs, identify areas for improvement, and allocate resources effectively. Methods of budgeting can vary, but some common techniques include zero-based budgeting, incremental budgeting, and activity-based budgeting.

Accounting and Financial Reporting: Best Practices and Considerations

Accounting and financial reporting are crucial to effective strategic management finance. Business owners should be familiar with best practices for financial reporting, including Generally Accepted Accounting Principles (GAAP). Additionally, they should be aware of the various accounting software and technology available to them, such as cloud-based accounting systems.

You might find these FREE courses useful

- Strategic Management – Capstone Project

- Strategic Technology Management Specialization

- Intro to Strategic Management for Healthcare Organizations

- Strategic Sales Management Final Project

Monitoring and Evaluation: Performance Metrics and Analysis

Once a strategic management finance plan has been implemented, it is important to monitor and evaluate performance. This involves tracking key performance metrics and analyzing financial data. Business owners can use this information to determine whether their strategies are working and make adjustments as necessary.

In conclusion, strategic management finance is essential to the success of any business. By developing a comprehensive plan that incorporates financial planning, investment strategies, risk management, cash flow management, budgeting, and accounting, entrepreneurs can help ensure the long-term health and growth of their company. Monitoring and evaluating performance metrics is also critical in order to make adjustments and optimize processes over time.