Introduction

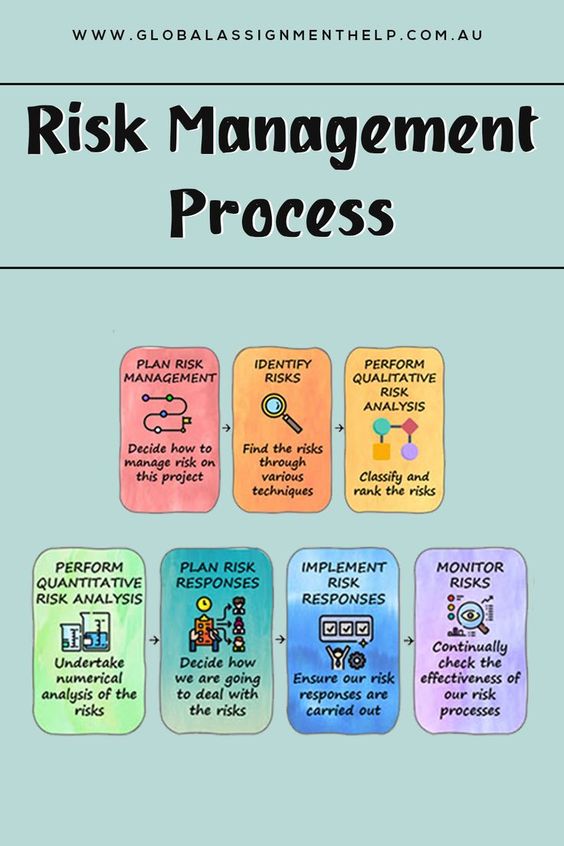

Risk management in finance is a process of identifying, assessing, and controlling risks that can have an impact on the financial operations of a business. It is a process of assessing and managing the potential risks that could affect the financial performance of a company. Risk management in finance is essential for any business to ensure its long-term financial health and sustainability.

What are the Benefits of Risk Management in Finance?

Risk management in finance helps businesses identify, assess, and manage the risks that could affect their financial operations. It helps to reduce the potential losses associated with financial risks, and can help to improve the performance of a business. Risk management in finance can also help to ensure that a business is better prepared to handle unexpected events or changes in the market.

What are the Different Types of Risk Management in Finance?

There are several different types of risk management in finance, including market risk, credit risk, operational risk, liquidity risk, and reputational risk. Market risk is the risk of losses due to changes in market prices or conditions. Credit risk is the risk of losses due to a borrower’s inability to repay a loan. Operational risk is the risk of losses due to operational errors or mismanagement. Liquidity risk is the risk of losses due to the inability to convert an asset into cash. Reputational risk is the risk of losses due to a company’s reputation being damaged.

How is Risk Management in Finance Implemented?

Risk management in finance is usually implemented by a risk management team or a risk management consultant. The team or consultant will assess the risks that could affect the financial operations of a business and develop a plan to reduce or manage these risks. The plan may include strategies such as diversifying investments, hedging, or insurance.

What are the Different Tools Used in Risk Management in Finance?

The different tools used in risk management in finance include risk assessment tools, risk management software, and risk management models. Risk assessment tools help to identify and assess the risks that could affect a business. Risk management software helps to monitor and manage the risks that have been identified. Risk management models help to analyze and evaluate the risks that have been identified and develop strategies to manage them.

How Can Risk Management in Finance Help a Business?

Risk management in finance can help a business to reduce the potential losses associated with financial risks and improve its financial performance. It can also help to ensure that a business is better prepared to handle unexpected events or changes in the market.

What are the Challenges of Risk Management in Finance?

The challenges of risk management in finance include the identification of risks, the ability to assess the risks, and the ability to develop strategies to manage the risks. Additionally, the implementation of risk management strategies can be difficult and costly.

You might find these FREE courses useful

- Program Risk Management in ClickUp

- Risk Management in Personal Finance

- Investment Risk Management

- Market Risk Management: Frameworks & Strategies

- Credit Risk Management: Frameworks and Strategies

- FinTech Risk Management

- Implementing a Risk Management Framework

- Risk Management Specialization

Conclusion

Risk management in finance is an essential process for any business to ensure its long-term financial health and sustainability. It helps to identify, assess, and manage the risks that could affect the financial operations of a business. Risk management in finance can help to reduce the potential losses associated with financial risks and improve the performance of a business.